Land value and categories

The NSW Valuer General provides independent land valuations at least every 3 years. Local councils use these valuations to help determine rates.

Land values Rating categories Request category change Local Government Act

Land values

Land value is based on factors such as recent sales, land use, zoning restrictions and nearby amenities. This is known as your unimproved capital land value. (It does not include the value of a house or property improvements.)

The Valuer General sends landholders a Notice of Valuation when council receives new land values. For more about land tax see Revenue NSW

How does land valuation affect my rates?

Only the General Rate of your rates notice is linked to your land valuation. This is known as the Ad Valorem component and it includes the minimum rate.

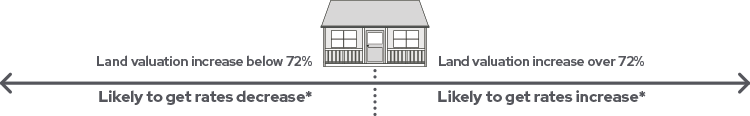

An increase in your land valuation does not necessarily mean an increase in your rates.

The impact of any land-valuation increase depends on how the increase compares with the average land valuation in the Tweed within your rating category (that is residential, farmland or business).

If your land valuation increase is lower than the average, you are likely to see a reduction in your rates.

If your valuation increase is higher than the average, you are likely to see a rise in your rates.

Head to rates explained to find out more about how rates are calculated.

Does Council collect more money when land valuations increase?

No. When land valuations increase, Council does not receive additional money.

The total rates revenue Council receives after revaluation is the same as the total rates revenue Council received before revaluation.

What changes is how the total rates revenue is shared across ratepayers.

The diagram below highlights the average residential property increase for the general rates component.

How do I have my land valuation reviewed?

Land holders who disagree with their land valuation can lodge an objection directly with the Valuer General within 60 days. (You must still pay your rates while your objection is being considered.)

Rating categories

The category of your property is shown on your rates notice.

There are 4 categories of rateable land, as defined by the Local Government Act 1993:

- residential

- farmland

- business

- mining (there are currently no properties in the mining category in the Tweed).

In broad terms, properties are categorised for rating according to their use (or when there is no use, according to zoning).

In the Tweed, if a property is not residential or farmland it will be categorised as business. These categories do not change zoning or create subdivision entitlements.

How to request a change in land category

At any time a ratepayer can apply to Council to have a land category reviewed.

The sections of the NSW Local Government Act 1993 relevant to changing your property's rating category are listed below.

Ensure that you read the information prior to submitting your application.

How can I appeal my land category?

Following a review, you can appeal if you are dissatisfied with either:

- Council's category of your land

- the date your land category takes effect.

You can appeal to the Land and Environmental Court within 30 days of a Council declaration of land category (under Section 526 of the Local Government Act 1993).

Local Government Act 1993

The relevant legislation comes under Chapter 15 How are councils financed. Follow the links below to view the relevant sections: