Rates explained

We collect rates from residents and businesses to help fund our infrastructure and services. Your rates notice includes service charges for your property.

Most land is subject to rates, and most people pay rates in the residential category. There's no GST for rates and charges on residential rates notices.

Council must levy rates and charges under the Local Government Act 1993.

How your rates are spent Breakdown of rates notice How rates are calculated Land valuations Cost shifting

Council Matters newsletter - How your rates keep our community running

Read this year's Council Matters for information about your rates and how your rates money is spent. View the interactive version below or you can download the Council Matters – Annual summary(PDF, 6MB).

What do your rates pay for?

Council provides more than 50 services to 98,000 residents – all funded by rates, charges, fees, grants and loans.

Rates help to pay for local services, and assets and facilities worth more than $3 billion. This includes infrastructure for individual properties, such as water and sewerage.

How every $100 you pay in rates and annual charges is spent

|

|

Sewer services |

$22 |

|

|

Roads, transport, drainage and flooding |

$19 |

|

|

Waste management and recycling |

$14 |

|

|

Administrative support services |

$13 |

|

|

Parks, sports fields, open space and aquatic centres |

$8 |

|

|

Planning, building, compliance, and emergency management |

$7 |

|

|

Community buildings, services, libraries, art and culture |

$6 |

|

|

Water supply (excluding water supply charges) |

$5 |

|

|

Environment and sustainability |

$3 |

|

|

Customer service, community engagement, communications and civic services |

$3 |

| |

Total |

$100 |

Our services

- Waste collection, recycling and street cleaning

- Water and wastewater treatment plants

- Water reservoirs, mains and supply network including pumping stations

- Wastewater pumping stations and mains

- Local roads, bridges, footpaths, kerb and guttering, signage and drainage maintenance and cycleways

- Parks, playgrounds, gardens, sports fields, aquatic facilities, skateparks and reserves

- Libraries and a range of community services (for elderly and youth)

- Community festivals arts and cultural assistance, and visitor information centre

- Town planning, landscaping, development applications / building inspections / construction certificates

- Ranger services, including dog control

- Strategic planning for the future

- Food shop inspections

- Environmental management

- Noxious weeds eradication

- Community facilities

- Services to the aged and youth

- Bus shelters

- Traffic management

Read more about Council services.

Our assets and facilities

- 1,079 km of sealed roads, 164 km of unsealed roads

- 210 km of footpaths, 790 km of kerb and gutters

- 5,678 street lights

- 208 concrete bridges, 35 wooden bridges

- 99 car park areas

- 376 km of drainage, 10.4 km of levee banks

- 400 flood gates

- Clarrie Hall Dam and 2 weirs

- 3 water treatment plants and 8 wastewater treatment plants

- 43 reservoirs

- 28 water and 185 wastewater pump stations

- 716 km of water mains and 700 km of sewer mains

- 33 community buildings and three community centres

- regional art gallery and museum

- 3 libraries and 2 civic centres

- 37 sports fields

- 378 parks and 82 playgrounds

- 78 picnic areas with barbecues in 39 Council parks

- 3 aquatic centres

- maintenance of public toilets and amenity blocks

- 11 cemeteries.

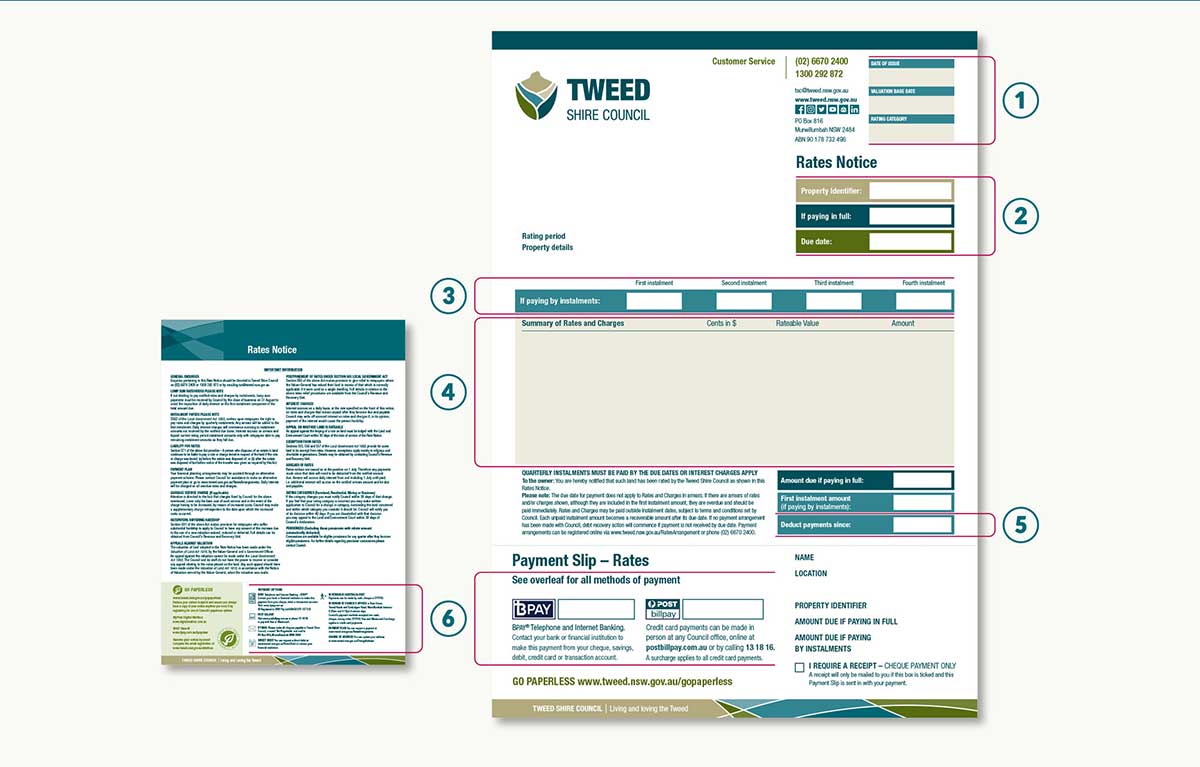

Breaking down your rates notice

Section 1

Date of issue

The date Council issued your rates.

The date Council issued your rates.

Valuation base date

The date the land was valued. For information visit www.valuergeneral.nsw.gov.au or to discuss your land value call 1800 110 038.

Rating category

Land within the Tweed is categorised as either ‘Residential’, ‘Business’, ‘Farmland’ or ‘Mining’. This determines the rate you are charged.

Back to rates notice

Section 2

Property identifier

A unique property number to identify your rates account. Please quote when making enquiries about your rates or water account.

A unique property number to identify your rates account. Please quote when making enquiries about your rates or water account.

Total amount due

Amount due, if paying in full.

Due date

This applies to either the full rate amount or the first instalment amount (see 3).

Back to rates notice

Section 3

Instalment dates and amounts

The dates and amounts due if paying by quarterly instalments. Council will send reminder Instalment Notices for the 2nd, 3rd and 4th instalments 30 days before they fall due.

Back to rates notice

Section 4

A list of rates and service charges payable on your property.

General rate

Calculated by multiplying your land value by the rate set by Council. If your rate calculation is less than the minimum rate you will be charged the minimum rate.

Back to rates notice

Section 5

Deduct payments since

The date on which information for your rate notice was extracted from Council’s database, any transaction after that date will not show on this notice.

The date on which information for your rate notice was extracted from Council’s database, any transaction after that date will not show on this notice.

Back to rates notice

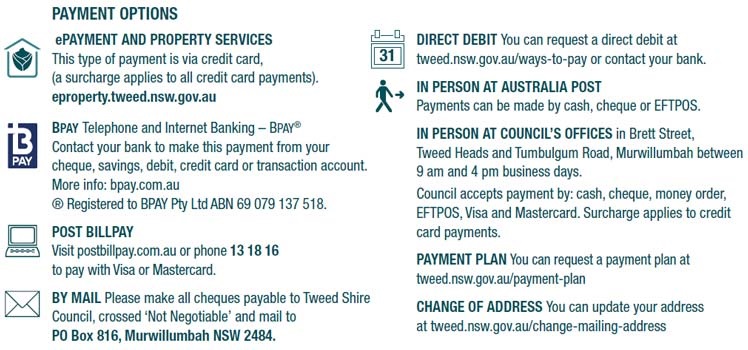

Section 6

Payment options

Some of the ways you can pay your rates. See the back page of your rates notice for the full list of payment methods.

Back to rates notice

Watch a video showing what makes up your rates notice (4 mins)

How rates are calculated

Council takes the total revenue to be collected from all rateable properties and divides it by the total value of all properties in the Tweed. This is called the rate in the dollar.

The rate in the dollar is multiplied by the unimproved capital value of each property to make sure each ratepayer pays a fair share.

Depending on your land value, your rates may be calculated using the minimum rate or the rate in the dollar.

Council does not receive more money when land values rise.

The only ways Council can increase its General Rate income is through a:

Service charges are also included in your annual rates notice, including water and sewerage access charges.

Tweed ratepayers are charged separately for water use.

Rate in the dollar

Council sets the rate in the dollar each financial year.

For 2025–26 these are:

- Residential 0.2784 cents per $ of land value

- Business 0.3029 cents per $ of land value

- Farmland 0.1823 cents per $ of land value.

To find the rate amount, the rate in the dollar is multiplied by the unimproved land value for each category.

Minimum rate

Each year Council sets a minimum amount for rates, a fair and reasonable contribution towards Council services.

The 2025–26 financial year minimum rate amounts are:

- Residential $1,274.05

- Business $1,400.50

- Farmland $1,274.05

Rates are calculated by multiplying the rate in the dollar by your unimproved land value. You are charged this amount, or the minimum rate (whichever is greatest).

Rates calculation 2025–26 (example only)

Unimproved land value = LV

Rate in the dollar = RD

Rates (residential) with land value $350,000

Rate in the dollar calculation (LV X RD) $350,000 x 0.002784 = $974.40

Minimum rate for residential = $1,274.05

Minimum rate applies = $1,274.05

Rates (residential) with land value $680,000

Rate in the dollar calculation (LV X RD) $680,000 x 0.002784 = $1,893.12

Minimum rate for residential = $1,274.05

Rate-in-the-dollar rate applies = $1,893.12

Special rates

Some residents pay a 'special' rate, such as residents of Koala Beach Estate. Read more about special rates.

Land valuations and the impact on rates

Council does not collect any more or less in rates following property revaluations.

Find out more about land values and categories and watch the video below to learn how rates are calculated.

Annual cost shifting report

Cost shifting refers to when higher levels of government transfer financial responsibilities onto lower tiers, like local councils, without providing adequate funding.

This can cause challenges for councils in maintaining essential services, due to the increasing burden of cost shifting from the state government and the constraints of rate pegging.

According to the latest report by Local Government NSW (LGNSW), councils shouldered an additional $1.5 billion in expenses for the 2023/2024 financial year, averaging $497.40 per ratepayer statewide.

Council is requesting urgent action from the NSW Government to address cost shifting - through regulatory reform and fair funding allocations – to ensure the sustainability of local government operations and the well-being of our communities.

For a comprehensive understanding of this issue, including access to the Cost Shifting 2025 Report and report summary, visit the LGNSW website.

Direct links to the report are included below: